How to Start Crypto Trading: A Beginner’s Guide for 2025

How to Start Crypto Trading

Starting your journey into cryptocurrency trading can feel both exciting and overwhelming! Did you know that over 420 million people worldwide now own some form of cryptocurrency? The crypto market has evolved dramatically since Bitcoin’s inception in 2009, creating countless opportunities for newcomers and experienced traders alike. If you want to learn how to start crypto trading, this guide will walk you through everything you need to know to start trading cryptocurrencies safely and effectively. From selecting the right exchange to implementing smart trading strategies, I’ll cover all the essentials to help you navigate this dynamic digital landscape.

Table of Contents

Understanding Cryptocurrency Basics

I still remember the day back in 2016 when my brother-in-law wouldn’t stop talking about Bitcoin at our family barbecue. He kept going on about how it would change the world and how I needed to “get in now.” I nodded along, pretending I knew what he was talking about while secretly thinking he’d joined some kind of digital cult.

Boy, was I wrong. And boy, do I wish I’d listened more carefully that day!

It took me nearly two years and a massive bull run to finally dive into the crypto world. What I found was fascinating, confusing, and honestly, a bit overwhelming. I made plenty of rookie mistakes along the way (like the time I accidentally sent some Ethereum to the wrong address – oops, there went $300 I’ll never see again). But through all the ups and downs, I’ve learned a ton about this technology that really is changing our financial landscape.

What Are Cryptocurrencies, Really?

At their core, cryptocurrencies are digital assets that use cryptography for security and operate on something called blockchain technology. Think of a blockchain as a super-secure digital ledger that keeps track of all transactions – kinda like a bank’s record system, but way more transparent and not controlled by any single entity.

Each “block” contains a bunch of transactions, and once it’s verified by network participants (called miners or validators), it gets added to the “chain” of previous blocks. That’s why it’s called blockchain! What makes this so revolutionary is that it’s decentralized, meaning no government or bank controls it, and it’s practically impossible to hack or alter past records.

The first time I truly understood blockchain, I was sitting in my pajamas at 2 AM watching YouTube videos. Something just clicked, and I thought, “This is gonna be bigger than the internet.” Maybe that was the sleep deprivation talking, but I still think there’s truth to it.

The Major Players in the Crypto World

Bitcoin (BTC) is the OG cryptocurrency, created in 2009 by the mysterious Satoshi Nakamoto (who might be a person, might be a group – nobody knows for sure!). It was designed as a peer-to-peer electronic cash system and has become digital gold – a store of value rather than something you’d use to buy coffee.

Ethereum (ETH) came along in 2015 and introduced something game-changing: smart contracts. These are basically self-executing contracts with the terms written in code. This innovation allowed for decentralized applications (dApps) and eventually gave rise to NFTs, DeFi, and a whole ecosystem of projects.

Then there’s a sea of other cryptocurrencies (often called “altcoins”) like Cardano, Solana, Polkadot, and literally thousands more, each with different use cases, technologies, and communities behind them. Some solve real problems, while others… well, let’s just say I’ve thrown money at some pretty questionable projects in my time.

Crypto Lingo and Investment Approaches

When I first started reading crypto forums, I felt like everyone was speaking another language. If you want to know how to start crypto trading, it is a good starting point to know a bit of basic lingo. Here’s a quick breakdown of terms I wish someone had explained to me:

- Coins vs. Tokens: Coins have their own blockchain (like Bitcoin), while tokens are built on existing blockchains (like many projects built on Ethereum).

- Wallets: These don’t actually “store” your crypto – they store the private keys that give you access to your assets on the blockchain. Hot wallets are connected to the internet (convenient but less secure), while cold wallets are offline storage devices (like a Ledger or Trezor).

- Exchanges: Platforms where you can buy, sell, and trade crypto. Centralized exchanges (like Coinbase or Binance) are user-friendly but hold your crypto for you, while decentralized exchanges (DEXs) let you trade directly from your wallet.

- DeFi: Short for Decentralized Finance, this refers to financial services built on blockchain technology that aim to cut out traditional financial intermediaries. Think lending, borrowing, and earning interest, but without banks.

You can learn a lot more about crypto lingo here.

Different approaches to the crypto market helped me develop a strategy that matched my personality and goals:

- Investing typically means buying crypto assets you believe in for the long term, based on fundamentals, use case, team, and technology. You’re looking at timeframes of years, not days or weeks.

- Trading involves more frequent buying and selling to capitalize on market movements. Some folks use technical analysis to make trading decisions, looking at charts and patterns to predict price movements. I tried this for a while and realized I don’t have the temperament (or skills) for it!

- HODLing (a famous typo of “holding” that became crypto slang / some call it “hold on for dear life”) means buying and holding regardless of price fluctuations. The classic HODL strategy is based on the belief that, despite volatility, prices will be higher in the long run.

After trying all three approaches, I settled on a hybrid strategy: long-term holding for 80% of my portfolio and occasional trading with the other 20% when I see opportunities. This lets me sleep at night while still feeling like I’m not missing out on shorter-term moves.

The Cyclical Nature of Crypto Markets

One thing to understand about the crypto market is its extreme cyclical nature. Before you know how to start crypto trading, it is good to know when to jump in or when to wait a bit. Since Bitcoin’s creation, we’ve seen several major bull and bear markets, each more dramatic than anything in traditional finance.

The 2017 boom saw Bitcoin go from around $1,000 to nearly $20,000, followed by a crushing bear market where it dropped below $4,000. Then came the 2021 cycle, pushing Bitcoin to $69,000 before falling back hard in 2022.

These cycles taught me patience. During my first bear market (also called a “crypto winter”), I nearly gave up on the space entirely. Watching your portfolio drop 70% is not fun. But those who stuck around and kept accumulating during those down periods were rewarded handsomely in the next cycle.

The volatility can be stomach-churning. I’ve had days where my portfolio swung by 30% in 24 hours. You definitely get used to it, but it’s not for the faint of heart. I’ve learned to zoom out and focus on long-term trends rather than daily price movements.

Setting Up for Success: Essential Requirements

Knowing how to start crypto trading isn’t just about having money to invest. There’s a whole infrastructure you need to put in place first, and I’ve learned that cutting corners here can cost you big time down the road. Trust me on this one—I’ve made pretty much every rookie mistake in the book.

Hardware and Software Essentials

For casual investing, you don’t need anything fancy—a reliable computer or even a decent smartphone will do the trick. But if you’re planning to do active trading or use advanced charting tools, you’ll want a setup that won’t lag or crash at crucial moments.

My current setup includes a computer with at least 8GB of RAM and a stable internet connection. Nothing too crazy, but way better than that ancient laptop I started with! I also have a backup device (my tablet) in case my primary system goes down.

As for software, you’ll need:

- A secure, updated operating system (keep those security patches current!)

- A password manager (I use KeePass. It is 100% free forever. LastPass is another option, although this requires a paid subscription. There are plenty of good options)

- Authenticator apps for two-factor authentication (Google Authenticator or Authy)

- Anti-virus and anti-malware protection

- A VPN for additional security when trading on public networks

I learned about the importance of a VPN the hard way. Back in 2019, I was traveling and decided to check my crypto portfolio using hotel WiFi. Two days later, I got email notifications about login attempts from strange locations. Thankfully, my 2FA saved me, but it was a wake-up call about network security.

Documentation for KYC

Once you register on an exchange, one of the first things you should know about how to start crypto trading is to submit your KYC. The first time I tried to join a major exchange, I was surprised by how much personal information they wanted. Know Your Customer (KYC) requirements mean you’ll need to verify your identity before trading on most legitimate platforms.

Be prepared to provide:

- Government-issued photo ID (passport, driver’s license)

- Proof of address (utility bill, bank statement from the last 3 months)

- A selfie or video verification holding your ID

- Sometimes, proof of income or source of funds

This process can take anywhere from a few hours to several days, which is super frustrating when you’re eager to start trading. Try to get verified on at least 2-3 exchanges even before you’re ready to trade, just to have options ready.

Some platforms have tiered verification levels, with higher limits requiring more documentation. At each level, you have a trading limit during a bull run and cannot buy more until your enhanced verification is approved.

.

Setting Realistic Expectations

The hardest requirement to prepare for is the mental aspect of crypto trading. I started with dreams of quick riches and found myself on an emotional roller coaster instead. This is probably the most difficult lesson for most to learn in how to start crypto trading.

In my first year, I was checking prices every 20 minutes, losing sleep during volatile periods, and making impulsive decisions based on FOMO (fear of missing out) or panic.

Knowing this will help you set realistic expectations:

- Prepare for extreme volatility—30% drops in a day are not uncommon

- Most people who try day trading end up losing money

- The time commitment for active trading is substantial and can affect your relationships

- Overnight success stories are rare and often exaggerated

- Bear markets can last years, not months

I eventually developed a trading plan with clear entry and exit points. An important discipline to master when you learn how to start crypto trading. This helped remove some emotion from my decisions. I also set strict limits on how often I check prices and make trades. For my mental health, I had to accept that there will always be missed opportunities, and that’s just part of the game.

My approach now is much more balanced. I’ve allocated only a portion of my investment portfolio to crypto (about 15%), set aside time once a week to review my holdings, and developed the discipline to stick to my strategy regardless of market hype. This has not only improved my returns but also dramatically reduced my stress levels.

Choosing the Right Cryptocurrency Exchange: A Complete Guide

In learning how to start crypto trading, you may find yourself completely overwhelmed by the number of cryptocurrency exchanges out there. Which one should I choose? Are they all safe? Why does this one charge so much less than the others? After creating accounts on five different platforms and making a mess of my crypto holdings, I learned that choosing the right exchange from the start could have saved me a ton of headaches. I discuss a few of the biggest exchanges below. For my complete list of trusted exchanges, you can read more about it here.

Centralized vs. Decentralized Exchanges

The first big decision you’ll need to make is whether to use a centralized exchange (CEX) or a decentralized exchange (DEX). Both have their place, and I actually use both for different purposes.

Centralized Exchanges like Coinbase, Binance, and Blofin function similarly to traditional brokerages. They’re companies that hold your assets, match buyers with sellers, and generally provide a smoother user experience. Binance was my first exchange, and I chose it precisely because it felt familiar, like the E-Trade of crypto.

My experience with each major CEX has been quite different:

- Coinbase is super user-friendly but charges higher fees. When I was just starting out, I happily paid those fees for the peace of mind. Their interface is intuitive, and I was able to buy Bitcoin within minutes of creating my account. The downside? I realized I was paying nearly 1.5% per transaction when other exchanges charged a fraction of that.

- Binance offers lower fees and more trading options, but I found their interface more complex. It took me a weekend and several YouTube tutorials before I felt comfortable navigating it. The upside was access to way more cryptocurrencies than Coinbase offered and fees as low as 0.1%. For me, the learning curve was worth it once I moved beyond just buying and holding a few major coins.

- Blofin is newer to the scene but has been gaining popularity for its focus on derivative trading. I dabbled with their platform when I was ready to try more advanced trading strategies like futures. Their security features impressed me, but I found their liquidation mechanisms to be quite aggressive compared to other platforms I’d used.

You can read more about the best crypto exchanges for beginners here, and about exchanges with the lowest crypto fees here.

Decentralized Exchanges like Uniswap, SushiSwap, and dYdX operate differently. Instead of trusting a company with your assets, you trade directly from your wallet through smart contracts. My first DEX experience was trying to buy a small-cap token that wasn’t available on mainstream exchanges, and I was terrified of making a mistake.

The big advantage of DEXs is that you maintain control of your crypto—no company can be hacked or suddenly freeze your account.

The tradeoff is that DEXs generally have more complex interfaces, higher blockchain fees (especially on Ethereum), and less liquidity for major trading pairs. Plus, if you make a mistake, there’s no customer service to help you recover your funds. I once sent tokens to the wrong address on a DEX and lost about $200—a painful lesson in double-checking everything.

Security Features: Non-Negotiable Elements

Knowing how to keep your assets safe is certainly the most important thing you should know about how to start crypto trading. After getting SIM-swapped in 2019 and nearly losing my exchange accounts (thank goodness for 2FA!), security features became my top priority when evaluating platforms.

Here’s what I look for now:

- Two-Factor Authentication Options: Any reputable exchange should offer 2FA. I prefer authenticator apps over SMS authentication since SIM swapping has become more common. Some exchanges now offer hardware key support (like YubiKey).

- Cold Storage Reserves: The best centralized exchanges keep the majority of user funds in cold storage—offline wallets that can’t be accessed through internet-based attacks. Coinbase, for example, stores over 98% of customer assets offline, which gave me enough confidence to keep some assets on their platform.

- Insurance Policies: Some exchanges now offer insurance to cover losses from security breaches. After the Mt. Gox disaster (before my time, thankfully), I find this particularly reassuring. Binance’s insurance coverage was one of the reasons I chose them for some of my holdings.

- Withdrawal Confirmations: Look for exchanges that require email confirmations, waiting periods, or whitelisted addresses for withdrawals. I once had a withdrawal request trigger a 24-hour security hold, which was annoying at the time but reassuring in retrospect.

- Regulatory Compliance: This might seem boring, but exchanges that comply with regulations in major markets tend to implement better security practices. I’ve steered clear of exchanges that jump from country to country to avoid regulatory oversight.

After trying both highly secure exchanges and more questionable ones, I’ve settled on a tiered approach: I use the most secure platforms for the bulk of my trading and holding, while accepting slightly higher risk on smaller platforms for access to specific tokens or features not available elsewhere.

Fee Structures and Interface Considerations

If I could go back and tell my beginner self one thing about exchanges when I was learning how to start crypto trading, it would be to pay closer attention to fees. It seems small, but it adds up tremendously, especially if you’re an active trader.

Here’s what to watch for:

- Trading Fees: These typically range from 0.1% to 1.5% per transaction. My early Coinbase trades at 1.49% seemed insignificant until I calculated that I’d paid over $700 in fees my first year—enough to buy a nice hardware wallet and take my friend to dinner!

- Deposit/Withdrawal Fees: Some exchanges charge flat fees for moving money in and out. Others, like Gemini, offer a certain number of free withdrawals each month, which can save you hundreds of dollars in Ethereum gas fees when the network is congested.

- Hidden Spreads: This was the fee I missed entirely at first. Some exchanges advertise “zero fees” but make money on the spread—the difference between buying and selling prices. I once did a test by buying and immediately selling the same amount of Bitcoin on a “no fee” exchange and lost almost 1.5% in the spread.

- Tier Benefits: Many exchanges reduce fees based on your trading volume or if you hold their native token. On Binance, holding BNB cut my trading fees by 25%—well worth it for the amount of trading I was doing.

Don’t underestimate how important a good interface is, especially early in your journey of learning how to start crypto trading. Try out Coinbase because it will feel familiar and non-threatening, then graduate to more complex platforms as you gain confidence.

Some exchanges seem designed by traders for traders, with charts and data everywhere. Others clearly prioritize newcomers with simple buy/sell options and educational content. There’s no right answer here—it depends on your experience level and goals.

My solution was to start on beginner-friendly platforms, then gradually try more complex ones as I learned. Many exchanges now offer both basic and advanced views (like Coinbase and Coinbase Pro), which gives you room to grow without switching platforms entirely.

Mobile apps are another consideration. Some exchanges have fantastic web platforms but terrible mobile apps, or vice versa. Since I often check my portfolio on the go, having a well-designed mobile app has become surprisingly important. Binance’s app has been the most reliable for me, while some smaller exchanges’ apps would crash precisely when I needed them most during volatile market movements.

Geographical Restrictions and Finding Your Match

This one caught me off guard during a work trip to Singapore. I tried to log into my usual exchange and got blocked because they didn’t serve users in that region. Geographical restrictions can seriously impact which exchanges are viable options for you.

Some factors to consider:

- Available Trading Pairs: Exchanges often offer different crypto pairs in different regions. I was surprised to find that some tokens I could easily buy in the US weren’t available on the same exchange in Europe.

- Fiat Currency Support: If you need to convert between crypto and your local currency, check which exchanges support direct transfers to your bank.

- Regulatory Requirements: Different countries have vastly different approaches to crypto regulation. When Japan implemented strict new rules in 2018, several exchanges simply exited the market rather than comply.

After years of trial and error, I’ve found there’s no perfect exchange for everyone. Your ideal platform depends on your trading frequency, technical comfort level, security concerns, and geographical location.

For beginners, I still recommend starting with more user-friendly, highly regulated exchanges despite their higher fees. The added security and simpler interface are worth it while you’re learning. As you gain confidence, you can explore platforms with more features and lower fees.

I’ve settled into using a combination of exchanges for different purposes: one with the best security for my long-term holdings, another with low fees for active trading, and a DEX for accessing newer tokens not yet available on mainstream platforms.

Creating and Securing Your Crypto Wallet

I’ll never forget the day I lost access to my first cryptocurrency wallet. A few years ago, I had about $3,000 worth of Ethereum stored in a software wallet. My computer crashed, and I suddenly realized with horror that I had no idea where I’d put my recovery phrase. I’d written it down somewhere “safe”—so safe that even I couldn’t find it. After tearing apart my office for three days, I finally found the piece of paper tucked inside an old book. That nerve-wracking experience taught me more about proper wallet security than any guide ever could.

Wallets are the foundation of your crypto journey, and getting this part right is non-negotiable.

Understanding Different Types of Wallets

Just when I learned how to start crypto trading, I assumed a wallet was just a wallet. Boy, was I wrong! There are several distinct types, each with different security profiles and use cases.

Exchange Wallets are the easiest to set up—just create an account on an exchange like Coinbase or Binance, and voilà, you have a wallet. I started here, like most people do. The convenience is fantastic—you can buy, sell, and store all in one place. But after the Mt. Gox hack (before my time) and seeing several smaller exchanges get compromised, I learned the hard truth behind the crypto saying: “Not your keys, not your coins.”

When you keep crypto on an exchange, you’re essentially trusting that company to secure your assets. For small amounts or frequent trading, this risk might be acceptable. I still keep about 10% of my holdings on exchanges for trading opportunities, but never my full stack.

Hot Wallets are software wallets connected to the internet, like MetaMask, Trust Wallet, or Phantom. My first “real” wallet was MetaMask, and I felt so empowered taking control of my private keys. Hot wallets give you full ownership of your crypto while maintaining reasonable convenience for transactions.

The downside? Being connected to the internet makes them vulnerable to malware, phishing, and other online attacks. I learned this lesson when a friend had his entire wallet drained after connecting to a fake DeFi website. Hot wallets are great for active use, but I wouldn’t recommend them for your life savings.

Cold Wallets (hardware wallets) are physical devices that store your private keys offline. It was long after I learned how to start crypto trading that I learned about cold wallets. It was only after my recovery phrase scare that I invested in a Ledger Nano S, and it was a game-changer for my peace of mind. Cold wallets are like digital vaults—your crypto is protected from online threats because the private keys never leave the device.

The trade-off is convenience. Making transactions requires physically connecting the device and confirming actions on it. This extra friction is actually a security feature. The night I almost panic-sold during a market crash, my hardware wallet was in my safe at home—that “inconvenience” saved me from a terrible decision as prices rebounded the next day.

Setting Up Your First Wallet: A Step-by-Step Guide

After helping several friends get started with crypto, I’ve found that many guides overcomplicate the process. Here’s the straightforward approach I now recommend for beginners:

Setting Up a Software (Hot) Wallet

- Choose a reputable wallet provider. I recommend MetaMask for Ethereum and ERC-20 tokens or Phantom Wallet for multi-chain support. Both have strong security track records.

- Download only from official sources. The number of fake wallet apps is staggering. When I helped my cousin set up his first wallet, we found three fake “MetaMask” apps on the app store! Always go directly to the official website or use links from their verified social accounts.

- Install and create a new wallet. The app will walk you through generating a new wallet. This usually takes less than five minutes.

- Write down your recovery phrase. In learning how to start crypto trading, this is the MOST CRITICAL step as far as it concerns hot wallets. Your wallet will generate a 12 or 24-word phrase that acts as the master key to your funds. I’ve known people who took screenshots of this (terrible idea) or typed it into Notes on their phone (also bad). Write it down on paper—multiple copies—exactly as shown, including the word order.

- Verify your recovery phrase. Most good wallets will ask you to confirm words from your phrase. Don’t skip this step! I once transposed two words when writing down my phrase, and this verification process caught my mistake.

- Set up additional security. Add a strong password and enable biometric authentication if available. On MetaMask, I also enable the auto-lock feature to secure my wallet after a few minutes of inactivity.

- Make a small test transaction. Before storing significant amounts, send a small amount of crypto to your new wallet and then try sending a tiny portion elsewhere. This confirms everything is working correctly.

Setting Up a Hardware (Cold) Wallet

When you’re ready to level up your security (which I recommend once your crypto exceeds $1,000 in value), here’s how to set up a hardware wallet:

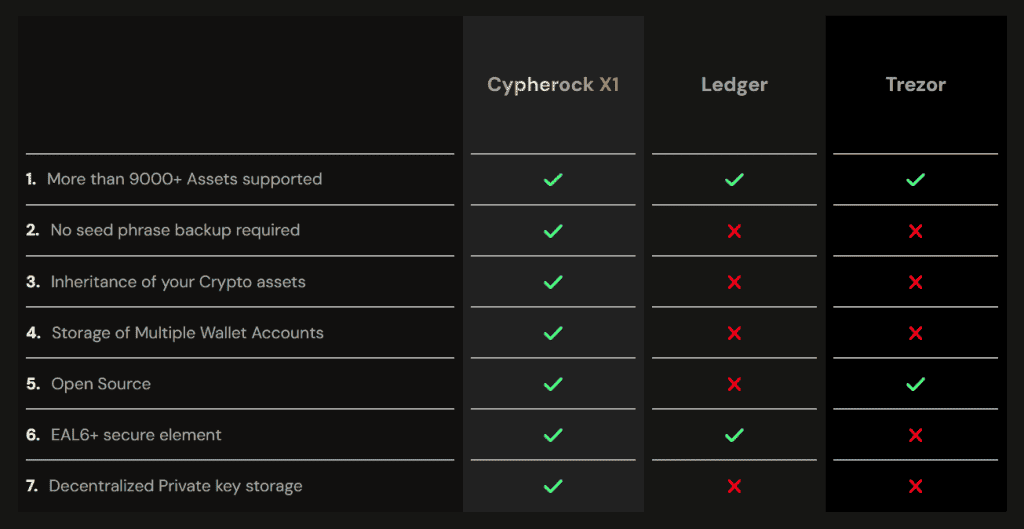

- Purchase directly from the manufacturer. I bought my second Ledger from Amazon and worried about tampering the entire time. Not worth the stress—buy directly from Ledger, Trezor, Cypherock (the world’s first hardware wallet without the need for a seed phrase backup), or other manufacturers.

- Check for tampering. Most devices come with tamper-evident packaging. My Ledger had a holographic seal that would show damage if opened. Inspect this carefully.

- Install the companion software. Hardware wallets work with desktop or mobile apps. Follow the manufacturer’s instructions precisely here.

- Set up your device. This usually involves creating a PIN code to protect physical access to the device. Read more about setting up your Ledger here.

- Record your recovery phrase. Just like with software wallets, your hardware wallet will generate a recovery phrase. The stakes are even higher here since this typically guards larger amounts.

- Add optional passphrase protection. For maximum security, many hardware wallets allow adding an extra passphrase. This creates a completely separate wallet instance that isn’t visible without the passphrase. I use this feature to create a “decoy” wallet with a small amount of funds and my “real” wallet with the bulk of my holdings.

- Test recovery procedures. Before trusting your device with significant funds, verify you can recover access. Some wallet manufacturers sell recovery checking devices, or you can reset your device and restore from your phrase as a test.

Securing Your Recovery Phrase and Advanced Security

The recovery phrase is the master key to your crypto kingdom. I have mentioned that security is the most important skill to master when learning how to start crypto trading. Consider this for securing recovery phrases:

- Never, ever store digitally. No photos, no text files, no password managers, no emails to yourself. Any digital storage dramatically increases the risk of theft. I have a friend who stored his phrase in his password manager, which then got compromised—bye-bye, Bitcoin.

- Use appropriate materials. Regular paper can degrade, get water damaged, or burn easily. After researching options, I now use a metal backup solution—essentially stamped metal plates that can survive fire, flood, and other disasters. Brands like Cryptosteel, Billfodl, and CypherSafe make good options that cost $50-100. Well worth it for protecting thousands or more in assets.

- Multiple copies, multiple locations. I keep three copies of each recovery phrase in physically separate locations. One at home in a fireproof safe, one in a bank safe deposit box, and one with a trusted family member. If any single location is compromised, I still have backups.

- Consider splitting phrases. For maximum security, you can split your 24-word phrase into multiple parts stored separately. For example, words 1-16 in one location and words 9-24 in another. This creates redundancy (words 9-16 appear in both locations) while ensuring no single compromised location reveals your full phrase.

- Have a clear inheritance plan. This is something I didn’t think about until a health scare in 2020. Make sure a trusted person knows where to find your recovery phrases and basic instructions on how to use them if something happens to you.

After a few years in the crypto space and hearing countless horror stories, I’ve added these extra layers of security to my setup:

- Passphrase protection: Beyond the recovery phrase, I use an additional passphrase (sometimes called a “25th word”) that isn’t stored anywhere. This creates a completely separate wallet instance that isn’t visible without the passphrase.

- Decoy wallets: I maintain smaller “decoy” wallets that would be visible if someone found my recovery phrase, while keeping the majority of funds in passphrase-protected wallets.

- Multisignature setups: For my largest holdings, I use multisig wallets that require multiple devices to sign transactions. This means a single compromised device can’t drain the wallet.

- Regular security audits: Every three months, I review all my security measures, check for firmware updates on hardware wallets, and sometimes rotate to new wallets if I have any security concerns.

These measures might seem paranoid, but in the crypto world, paranoia pays off.

Making Your First Cryptocurrency Purchase

I still remember the butterflies in my stomach when I made my first crypto purchase when I began learning how to start crypto trading. I’d spent weeks researching Bitcoin, created accounts on three different exchanges, and still felt completely unprepared when it came time to actually buy some. I stared at the screen for a good 20 minutes before finally clicking “Buy”—then immediately panicked about whether I’d done it correctly.

If you’re feeling similarly anxious about your first purchase, you’re not alone! The process can seem intimidating, but I promise it gets easier with practice.

Funding Your Exchange Account

Bank Transfers are usually the cheapest funding method. When learning how to start crypto trading, this was the method I followed first. Most exchanges support ACH transfers (in the US) or SEPA transfers (in Europe). My first deposit took nearly 5 business days to complete, which felt like an eternity when I was eager to start trading.

The upside to bank transfers is lower fees—typically between 0-1.5% depending on the exchange. Some platforms offer free deposits.

Pro tip: The first transfer to a new exchange is often the slowest because they’re verifying your banking details. Subsequent transfers tend to be faster, sometimes even same-day on platforms like Coinbase and Binance.

Credit and Debit Cards provide instant access to trading but typically incur fees between 3-5%, which can significantly eat into your investment. On a $1,000 purchase, that’s $30-50 just in fees. I now only use cards when I’m in a genuine rush to catch a specific price movement.

Important warning: Some credit card companies treat crypto purchases as “cash advances,” which start accruing interest immediately and may not qualify for rewards points.

Other funding methods include:

- PayPal/Venmo: Available on platforms like Coinbase with moderate fees (around 2-3%). I’ve used PayPal a few times when I needed slightly faster deposits than bank deposits, but couldn’t justify credit card fees.

- Wire Transfers: Faster than ACH (usually same-day or next-day) but typically come with a flat fee ($10-30). I’ve used this for larger purchases where the flat fee made more sense proportionally.

- Peer-to-Peer: Platforms like Binance P2P, Bitget P2P, or Bybit P2P let you buy directly from other users using various payment methods. The pricing can be higher, but it sometimes provides options when traditional methods aren’t available. The seller determines the exchange rate and typically hikes it with about a 3-5% premium over the market price. There are many sellers on Binance – this is where I usually do P2P trading, and with patience, you may find good deals.

Navigating the Exchange Interface

Once your account is funded, it’s time for the exciting (and slightly nerve-wracking) part—actually getting to know how to start crypto trading and buying some crypto! Exchange interfaces vary widely, but they all have certain common elements.

The Beginner-Friendly Route

Most major exchanges offer a simplified buying experience for newcomers. My first purchase was through Binance’s basic interface, where I simply:

- Selected Bitcoin from the available cryptocurrencies

- Entered how much I wanted to buy ($200 worth)

- Reviewed the fees and total cost

- Clicked “Buy Now”

I have a detailed blog on how to trade on Binance here.

This approach is straightforward but typically comes with higher fees. I still trade on Binance often because of its low trading fees. It felt like training wheels for crypto trading. If you want to look at exchanges with the lowest trading fees, read my blog here.

The Trading Platform Experience

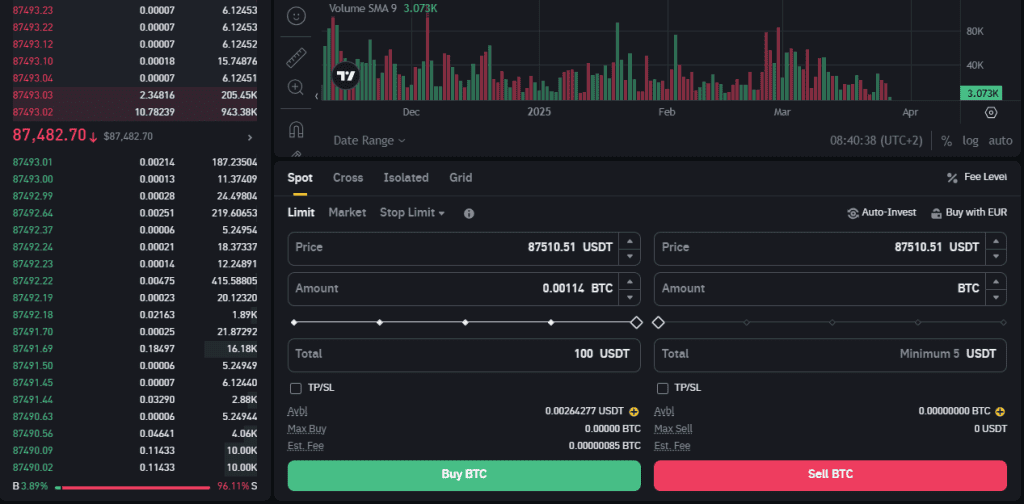

After a few basic purchases, I wanted more control over my buying price. That’s when I switched to the exchange’s full trading platform (like Coinbase Pro, Binance’s advanced view).

The first time I saw a full trading screen, I felt completely overwhelmed. There were charts with strange lines, an order book with constantly changing numbers, and various order types I didn’t understand. But after watching a few YouTube tutorials, I started to make sense of it all.

Here’s what I wish someone had explained to me about the basic components when I was learning how to start crypto trading:

- Trading Pairs: These show which cryptocurrencies you’re exchanging between, like BTC/USD (buying Bitcoin with US dollars), BTC/USDT (buying Bitcoin with Tether) or ETH/BTC (buying Ethereum with Bitcoin). I initially found this confusing—especially when trading between cryptos—but it becomes second nature with practice.

- Order Box: This is where you enter how much you want to buy and what type of order you want to place. My first few orders, I accidentally entered the wrong amount because I was thinking in dollars but the exchange was expecting Bitcoin amounts. Double-check this before submitting!

- Charts: These show the price history of your selected cryptocurrency. Basic charts show simple price action, while more advanced views include trading volume and technical indicators. I ignored these completely for my first few months while learning how to start crypto trading, then gradually started using them to identify general trends.

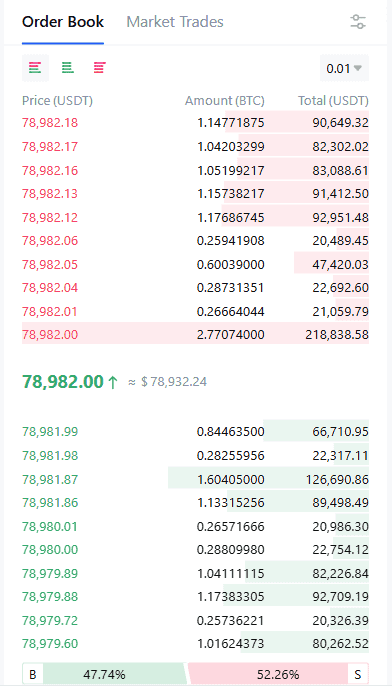

- Order Book: This shows pending buy and sell orders at different price levels. The “spread” between the highest buy offer and lowest sell offer represents the market’s current supply and demand balance. Wide spreads (common in less popular cryptocurrencies) mean you’ll pay more to buy and get less when selling.

Market Orders vs. Limit Orders

When I made my first purchase while learning how to start crypto trading, I used a market order without really understanding what it meant. I just wanted Bitcoin, and I wanted it now! Later, I realized I could have saved money by using a limit order instead.

Market Orders execute immediately at the best available price. The convenience is that your order fills right away, but you don’t have control over the exact price. During my first volatile market experience, I placed a market order and ended up paying 2% more than the price I saw moments before—a phenomenon called “slippage” that’s common during rapid price movements.

Limit Orders allow you to set the maximum price you’re willing to pay. Your order only executes if the market reaches your specified price. I now use these almost exclusively because they give me much more control. The downside is that if the price keeps rising, your order might never fill. I once set a limit order for Ethereum at $1,800 when it was trading at $1,850, expecting a small dip. Instead, it rallied to $3,000, and my order never executed—a missed opportunity!

For beginners still learning how to start crypto trading, I suggest starting with market orders for your first few purchases to get comfortable with the process. As you gain confidence, experiment with limit orders to get better prices and reduce fees.

Reading Price Charts and Executing Your First Buy

Even understanding the basics of price charts would have helped me avoid some poorly timed purchases. This is an important aspect of learning how to start crypto trading. Here’s what I now pay attention to:

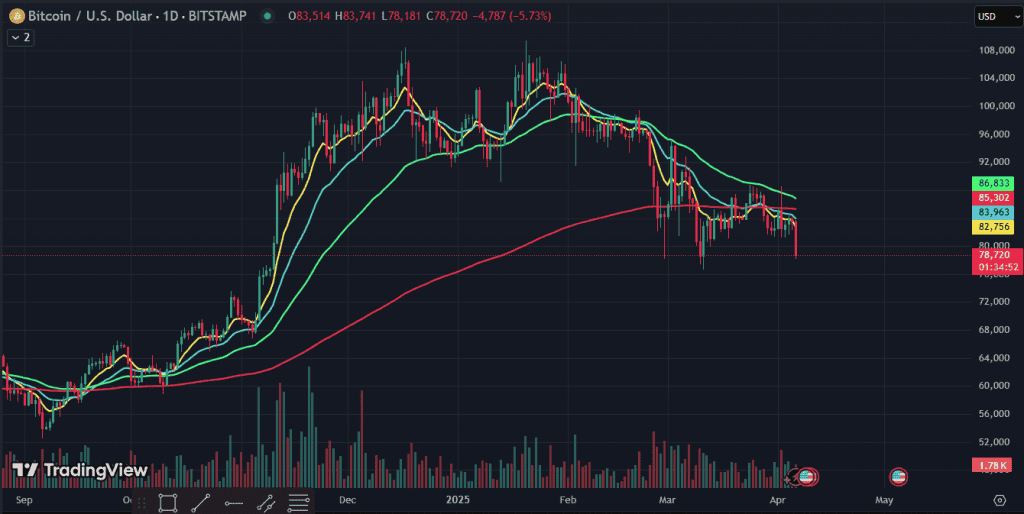

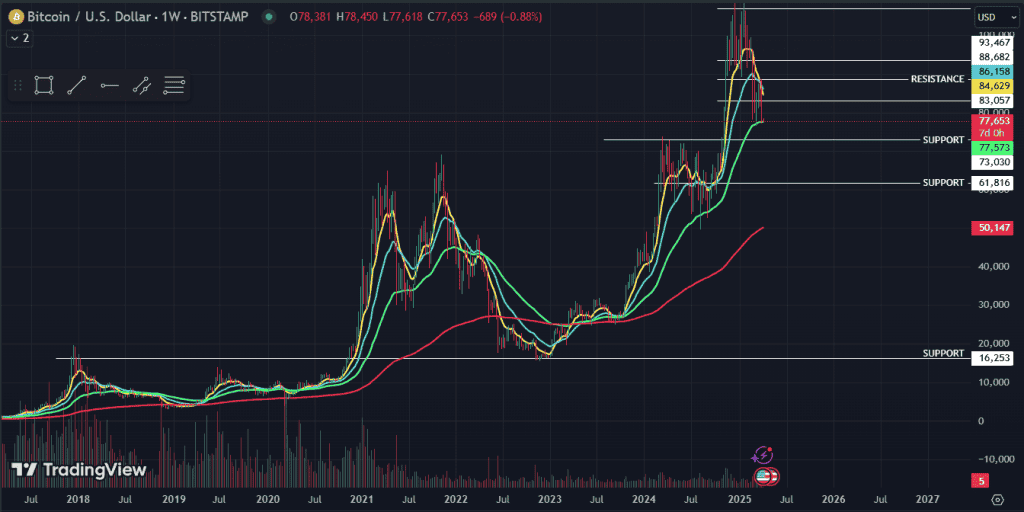

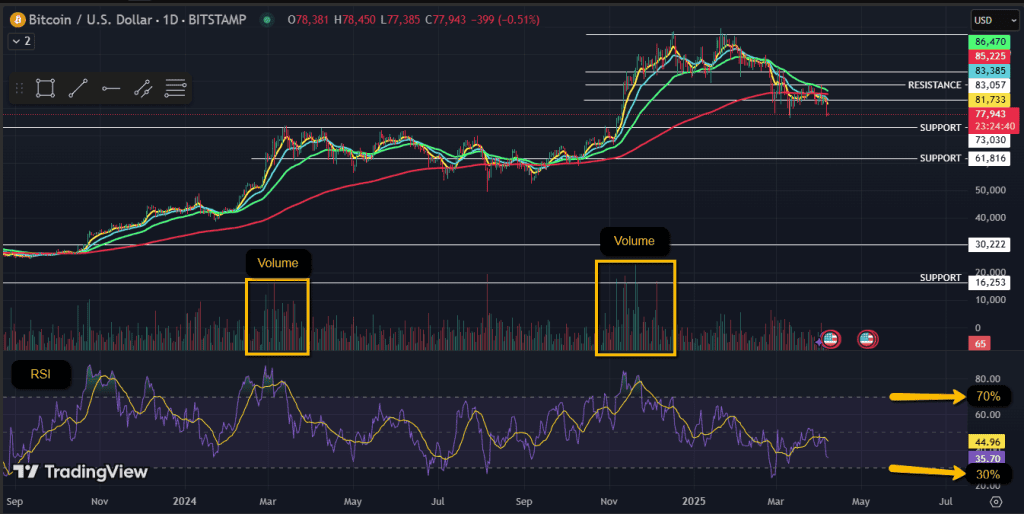

- Timeframes: Most exchanges let you switch between different views—hourly, daily, weekly, etc. For your first purchases, look at daily or weekly charts to get a sense of the overall trend rather than getting caught up in minute-by-minute fluctuations. Note that my Bitcoin chart above has a daily timeframe.

- Overall Trend: Is the price generally moving up, down, or sideways? Try to avoid buying when the price has just made a dramatic upward spike.

- Volume: This shows how much trading activity is happening. Higher volume generally means more liquidity and more reliable price movements. Notice how volume spiked in November on the Bitcoin chart above. This was also when the price rally happened.

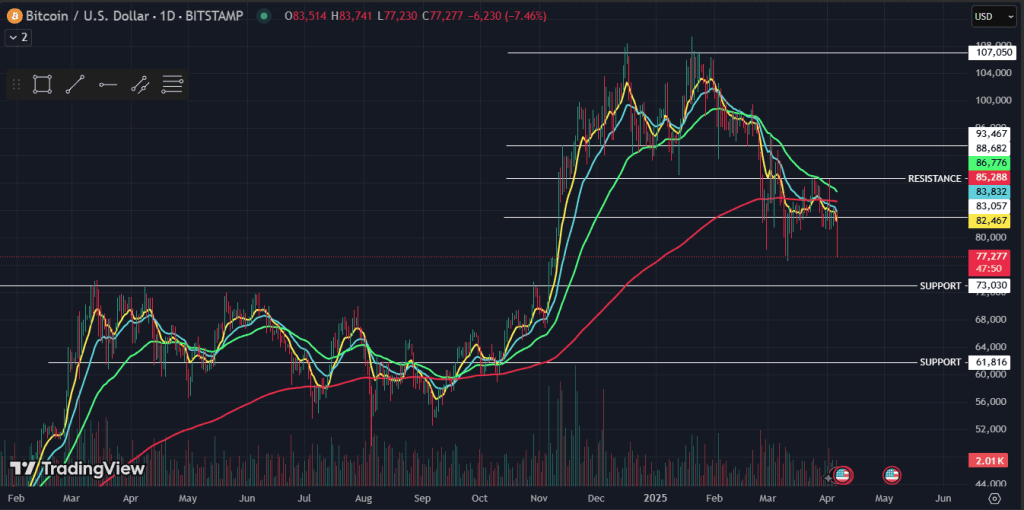

- Support and Resistance Levels: These are price points where the cryptocurrency has historically had difficulty falling below (support) or rising above (resistance). After some practice, I started identifying these levels on charts and using them to inform my buying decisions—trying to buy near support levels rather than resistance.

Based on my experience, here’s the process I now recommend for making your first purchase:

- Choose a cryptocurrency to buy – For beginners who are still finding out how to start crypto trading, I suggest starting with Bitcoin, Solana, or Ethereum. They’re the most established, which means less volatility than smaller altcoins.

- Decide how much to invest – Only use money you can afford to lose. My rule of thumb has been to start with a small amount (I began with $200) and gradually increase as you become more comfortable.

- Select your order type – For your first purchase, a market order is simplest. As you gain experience in how to start crypto trading, try using limit orders to get better prices.

- Double-check everything – Verify the trading pair, amount, and order type before submitting. I once accidentally bought Litecoin instead of Bitcoin because I clicked on the wrong trading pair.

- Place your order – Click the buy button and watch as your order executes. Congratulations! You now own cryptocurrency.

- Record the transaction details – For tax purposes, note the date, amount, and purchase price.

Transferring to Your Secure Wallet: The Final Step

After making your purchase, the cryptocurrency sits in your exchange wallet. While this is convenient for trading, it’s not ideal for security. As the crypto saying goes: “Not your keys, not your coins.”

Here’s my process for transferring crypto to a more secure wallet:

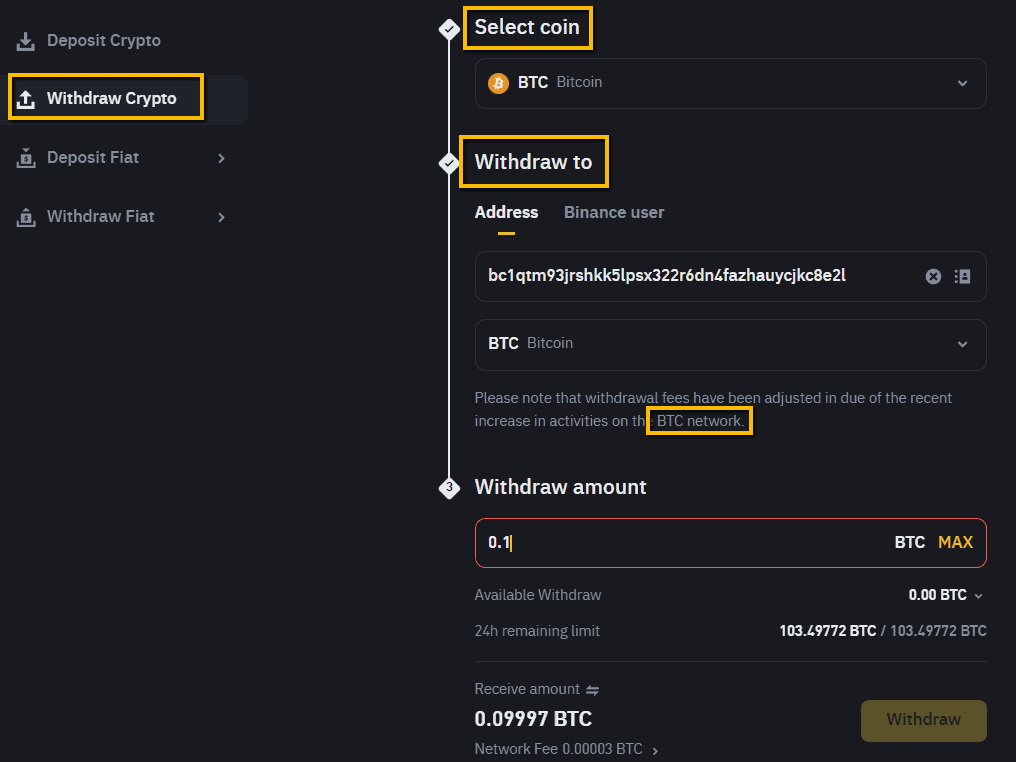

- Select the withdrawal option on your exchange (usually found in the wallet or funds section).

- Enter your wallet address carefully. This is a long string of characters that serves as your wallet’s “location” on the blockchain. I always copy-paste addresses rather than typing them manually and still double-check the first and last few characters.

- Start with a small test transaction if it’s your first time withdrawing to a particular wallet. I send a minimum amount, confirm it arrives correctly, then send the rest. The small fee is worth the peace of mind. I still do this, even after I confidently learned how to start crypto trading.

- Select the network (if applicable). Some cryptocurrencies, like USDT can be sent on multiple blockchains. Sending on the wrong network can result in lost funds. My mistake here cost me $75 worth of USDT when I selected the wrong network option. Typically, if you send USDT to your Ledger wallet, you need to use the Ethereum chain. It will clearly show this on your ledger. Ethereum goes on the Ethereum chain. Bitcoin goes on the Bitcoin chain. Solana goes on the Solana chain. But when you look at a coin like Doge. Well, Doge was built on the Ethereum chain, and therefore it will be sent through the Ethereum chain.

- Review the transaction details, including the fee. Blockchain transaction fees vary widely depending on network congestion. During the 2021 NFT boom, I once paid $65 in Ethereum gas fees for a $200 transfer—an expensive lesson in timing my transfers during lower-fee periods. Ethereum is typically very expensive compared to other chains. Currently, Solana fees are about $0.009 compared to an ETH withdrawal from Binance, which is 0.0006 ETH. ETH currently trades for $1580. So 0.0006 ETH is about $0.948. When the network is busy, which often happens during volatility, you should not be surprised to pay as much as $1000 in fees while Solana’s fees might go as high as $5. This is what makes coins built on the Solana chain so attractive. In the Bitcoin withdrawal image above, right at the bottom, you can see that the fee to withdraw Bitcoin is 0.00003 BTC. Bitcoin is currently trading for $78300, which means your withdrawal fee is approximately $2.35.

- Confirm and wait for the transaction to complete. Depending on the cryptocurrency and current network conditions, this could take anywhere from a few seconds to several hours.

- Verify receipt in your wallet once the transaction is complete. Check that the amount received matches what you sent (minus the network fee).

Essential Trading Strategies for Beginners

When I made my first few crypto trades while still figuring out how to start crypto trading, I was flying completely blind. I bought when prices looked “cheap” and sold when they seemed “expensive” – with absolutely no strategy beyond gut feeling. The result? I made some lucky gains during the bull market and then watched in horror as my portfolio plummeted 70% during the ensuing bear market. If only someone had sat me down and explained some basic trading strategies before I started throwing money around!

Dollar-Cost Averaging: The Strategy That Saved My Portfolio

My biggest early mistake was trying to time the market perfectly. I’d obsessively watch price charts, convinced I could predict the next move. Sometimes I’d get lucky, but more often I’d buy at local peaks out of FOMO (fear of missing out) or sell during temporary dips out of panic. While you are still getting to know how to start crypto trading, I highly recommend this approach.

The concept is beautifully simple: invest a fixed amount at regular intervals, regardless of price. By buying consistently over time, you average out your purchase price and reduce the impact of volatility.

Here’s how I implement DCA:

- I decide on a fixed amount I can comfortably invest (for me, it’s $200 per paycheck)

- I set up automatic purchases on the same day each month

- I stick to the schedule regardless of market conditions

During the 2021 bull market, this sometimes meant buying when prices seemed outrageously high. In July 2021, I remember feeling silly buying Bitcoin at $50,000, thinking “this has to be the top!” But I stuck to my plan. Similarly, during the 2022 bear market, I continued buying at regular intervals even as prices crashed, which dramatically lowered my average purchase price.

The psychological benefit has been just as valuable as the financial one. DCA removed the emotional stress of trying to time-perfect entries. I no longer agonize over daily price movements because I know my strategy works over the long term.

One tweak I’ve made to basic DCA is allocating slightly larger amounts during major market downturns. I keep a small reserve of cash (about 20% of my crypto budget) that I deploy when prices drop more than 30% from recent highs. This “enhanced DCA” approach has helped me capitalize on major dips while maintaining the discipline of regular investing.

Technical Analysis Fundamentals

After about a year of blind trading and getting to know how to start crypto trading, I started noticing something interesting on price charts: certain price levels seemed to act as floors (where prices stopped falling) or ceilings (where rallies stalled). Look at my Bitcoin chart shared earlier. I have drawn in support and resistance levels for you so you can see how the price fluctuates between these levels. I later learned these were called support and resistance levels, and understanding them dramatically improved my trading decisions.

Support levels are prices where historically there’s been enough buying interest to stop a downtrend. Resistance levels are prices where selling pressure has previously halted uptrends. I started marking these levels on my charts and using them to inform my buying and selling decisions.

When I first discovered technical analysis, I went overboard. My charts looked like a crayon explosion with dozens of indicators, most of which I didn’t fully understand. This is a typical mistake made by people who are still learning how to start crypto trading. After much experimentation, I’ve narrowed down to a few simple indicators that genuinely help my decision-making.

Exponential Moving Averages became my go-to for identifying overall trends. The 50-day and 200-day moving averages in particular have been invaluable. That is the red and green lines on the chart above. When the price is above these averages, the trend is generally up; below them, it’s down. The “golden cross” (when the 50-day crosses above the 200-day) and “death cross” (when the 50-day crosses below the 200-day) have often signaled major trend changes.

Relative Strength Index (RSI) helps me gauge whether an asset is potentially overbought or oversold. When the RSI climbs above 70, the asset might be overbought and due for a pullback. When it drops below 30, it might be oversold and due for a bounce. I’ve found this particularly useful for timing entries and exits within my broader strategy. When you are new and still learn the ropes of how to start crypto trading, you may be tempted to use this on low time frames. This works best on 4-hour and 1-day timeframes. Switch to shorter timeframes when you are skilled.

Volume is an indicator I initially overlooked but now consider essential. Price movements with high trading volume tend to be more significant and lasting than those with low volume. A price breakout accompanied by a surge in volume is more likely to continue, while one with declining volume might be a false signal.

For beginners who are still learning how to start crypto trading, I suggest starting with just these three indicators—exponential moving averages, RSI, and volume. They’re easy to understand, available on most trading platforms, and provide complementary insights without overwhelming you with information.

How to Start Crypto Trading and Fundamental Analysis

When I was still learning how to start crypto trading, my focus was entirely on price action and technical indicators. This tunnel vision led me to invest in projects with slick marketing and price momentum but questionable long-term value. After watching several of these investments crash and never recover, I learned to incorporate fundamental analysis into my decision-making.

Unlike stocks with established metrics like P/E ratios and revenue growth, cryptocurrency fundamental analysis requires different approaches. Here’s what I now look at:

- Development Activity and GitHub Commits show whether a project is actively building and improving. I was initially invested in a project with a beautiful website, but hadn’t updated its code in months—a red flag I missed by not checking their GitHub repository.

- Token Economics (“Tokenomics”) determines how a cryptocurrency is distributed, used, and potentially valued. I’ve learned to investigate:

- Total supply and circulation schedule

- Token utility within the ecosystem

- Inflation/deflation mechanisms

- Distribution among the team, investors, and community

- CoinMarketCap, CoinGecko, Defillama, and DexScreener are good sites where you can learn more about a coin’s tokenomics. In 2020, I invested in a project without researching its tokenomics, only to experience severe dilution when large amounts of tokens were released to early investors who immediately sold. Now I always check token release schedules before investing.

- Team and Community behind a project significantly impact its chances of success. I evaluate:

- Team experience and track record

- Community size and engagement, especially on X, Telegram, and Discord.

- Quality of communication from leadership

- Transparency about challenges and roadblocks

- Real-World Adoption and Partnerships matter more than speculative hype. I track metrics like:

- Active users and transactions

- Integration with existing systems

- Meaningful partnerships with established entities

- Revenue or value captured by the protocol

For beginners, fundamental analysis might seem overwhelming, but even basic research puts you ahead of many traders who buy based solely on price movements or social media hype. I start with simple questions: What problem does this solve? Who’s building it? Are people actually using it? How does the token accrue value? Honest answers to these questions have saved me from numerous poor investments.

Using Stop-Loss and Take-Profit Orders

My early trading lacked any form of risk management. I’d buy crypto and then agonize over every price movement, often making emotional decisions at the worst possible moments. Learning to use stop-loss and take-profit orders transformed my approach by automating my exit strategy and removing emotion from the equation.

Stop-Loss Orders automatically sell your position if the price falls to a specified level. The first time I set a stop-loss was for an Ethereum position in early 2021. When a sudden market correction triggered my stop-loss, I initially felt regret as the price temporarily went lower before recovering. However, having that automated exit prevented me from panic-selling at an even lower price or holding through an extended downturn.

Take-Profit Orders are the flip side—they automatically sell when prices reach predefined targets. I’ve found these particularly useful for more speculative investments where I want to recover my initial capital while letting the rest ride.

My strategy now includes setting take-profit orders to sell 50% of speculative positions once they double in value. This “free position” approach means I’ve recovered my initial investment, so I can hold the remaining position with much less emotional attachment regardless of subsequent price action.

If you are still learning how to start crypto trading, I recommend starting with simple stop-loss orders on every position. Even a basic risk management approach is better than none at all. As you gain experience, you can develop more sophisticated strategies combining different types of orders.

Risk Management and Psychology in Cryptocurrency Trading

I’ll never forget the night in May 2021 when I woke up at 3 AM, checked my phone out of habit, and saw my crypto portfolio had dropped 30% in hours. My heart was pounding, my palms were sweating, and I nearly panic-sold everything. Instead, I put my phone down, took some deep breaths, and went back to sleep. By morning, the market had partially recovered, and I was grateful I hadn’t acted on that middle-of-the-night fear.

That experience taught me something crucial: in crypto trading, managing your psychology is just as important as managing your money. I’ve since learned that the most sophisticated trading strategies mean nothing if you can’t control your emotions when the market gets wild—and believe me, it will get wild.

Only Trade What You Can Truly Afford to Lose

When I first started in crypto, I heard the advice “only invest what you can afford to lose” so often that it became background noise. I nodded along while secretly thinking, “But I’m not going to lose it—I’m going to make a fortune!”

That overconfidence led me to invest more than I should have in 2018. When the bear market hit, I found myself checking prices dozens of times daily and losing sleep over my diminishing portfolio. The stress affected my job performance, my relationships, and my health.

The real meaning of “what you can afford to lose” finally clicked when I realized it’s not just about financial survival—it’s about emotional survival too. Your crypto trading budget should be money that, if it disappeared completely tomorrow, would make you say “Well, that sucks” rather than “I’m financially ruined.”

I now use a simple framework:

- Survival Money: Rent/mortgage, food, utilities, insurance, emergency fund. Never, ever touch this for crypto.

- Lifestyle and Goals Money: Savings for vacations, a new car, house down payment, etc. This money shouldn’t go into crypto either.

- True Risk Capital: What’s left after the essentials and planned expenses? This is your potential crypto budget.

For me, this ended up being about 10% of my monthly savings. That number will be different for everyone based on income, responsibilities, and risk tolerance. The key is being brutally honest with yourself about what “affordable loss” really means.

Diversification in Crypto

My first crypto portfolio was 100% Bitcoin. Then I discovered Ethereum and went all-in on that instead. Then I got excited about a small-cap altcoin and moved 75% of my holdings there. Each of these all-in moves resulted in periods of spectacular gains followed by devastating losses—a rollercoaster I could have avoided with proper diversification.

Diversification in crypto looks different than in traditional investing. Here’s how I approach it now:

By Market Cap Tiers: I allocate investments across different market capitalization levels:

- Large caps (Bitcoin, Ethereum): 60-70% of my crypto portfolio

- Mid caps (top 20-50 by market cap): 20-25%

- Small caps (lower ranked, higher risk/reward): 5-10%

By Use Case/Sector: I further diversify by ensuring my investments span different sectors within the crypto ecosystem:

- Store of value (Bitcoin)

- Smart contract platforms (Ethereum, Solana)

- DeFi protocols (lending, exchanges)

- Infrastructure (oracles, layer-2 solutions)

- Web3 applications

By Correlation: True diversification means having some assets that don’t necessarily follow crypto market movements. In my broader financial portfolio, I make sure to have:

- Traditional investments (stocks, bonds, index funds)

- Some physical assets (I chose precious metals)

- Cash reserves (both for emergencies and for buying opportunities)

The challenging part of diversification is maintaining it. During bull markets, your highest-performing assets will naturally become a larger percentage of your portfolio. I now rebalance quarterly, selling some of my best performers and redistributing to maintain my target allocations. This discipline forces me to take profits during good times and buy during downturns—exactly the opposite of what emotions would suggest.

Emotional Control and Trading Psychology

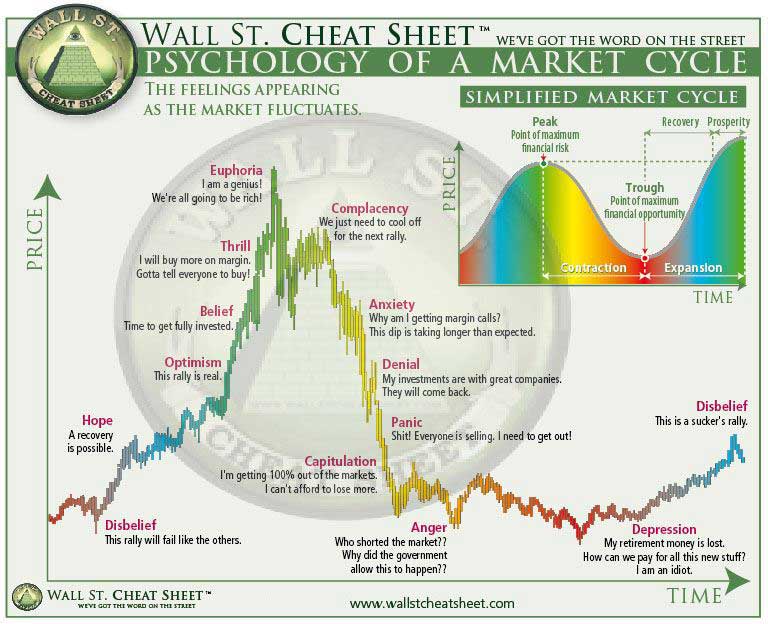

No aspect of trading has challenged me more than controlling my emotions during market volatility. I’ve experienced the full spectrum—euphoria during bull runs and despair during crashes, greed when prices rise and fear when they fall.

The breakthrough came when I realized these emotions weren’t weaknesses or character flaws—they’re normal human responses to uncertainty and volatility. The goal isn’t to eliminate emotions but to prevent them from driving your decisions.

Here are the strategies that have helped me maintain emotional balance:

- Set Clear Rules Before You Need Them: I established specific conditions for buying and selling based on my research and strategy. When emotions are running high, I refer to these pre-set rules rather than making in-the-moment decisions. For example, I decided to take profits when any position doubles, selling half to recover my initial investment. This rule saved me when a token I loved pumped 300% then crashed to zero.

- Limit Your Exposure to Market News: I used to consume crypto content constantly—Twitter, Reddit, YouTube, and podcasts. This information overload amplified my emotional reactions. Now I check prices and news on a schedule (mornings and evenings) rather than constantly, and I take weekend “crypto detox” breaks to maintain perspective.

- Keep a Trading Journal: I document every trade with my reasoning, expectations, and emotional state. Reviewing this journal revealed patterns—I often bought out of FOMO and sold out of panic. Simply being aware of these tendencies helped me catch myself before making similar mistakes.

- Practice Mindfulness: This might sound woo-woo, but basic mindfulness techniques have transformed my trading psychology. When I feel crypto anxiety rising, I take a few minutes to breathe deeply and check in with my physical reactions. This small pause often prevents impulsive decisions.

- Have Accountability Partners: I have two friends who also trade crypto, and we check in with each other before making major moves. Sometimes, just explaining my reasoning out loud reveals flaws in my thinking that emotions had obscured.

Avoiding Common Beginner Mistakes and FOMO

If I could go back in time and give my beginner self advice, I’d focus on avoiding these costly mistakes that nearly every crypto novice makes:

- Chasing Pumps: I lost thousands buying coins that had already surged 50-100% in days, only to see them crash shortly after I bought. I’ve learned that when everyone is talking about a coin and your taxi driver is giving you tips on it, it’s probably too late. Now I look for assets with strong fundamentals that haven’t yet had their moment in the spotlight.

- Panic Selling During Crashes: In my early days, each major dip triggered a fear response—”What if it goes to zero?” I’d sell at a loss, only to watch prices recover days later. I gradually trained myself to see downturns as potential buying opportunities rather than catastrophes. During the March 2020 COVID crash, rather than panic-selling, I added to my positions—a decision that paid off enormously in the subsequent bull run.

- Overtrading: Constant buying and selling not only racked up fees but also increased my stress and usually underperformed simply holding good assets. My trading frequency has decreased by about 80% since I started, and both my returns and mental health have improved as a result.

- Ignoring Tax Implications: My first year in crypto, I made dozens of trades without keeping proper records or understanding tax obligations. The following April was a nightmare of reconstructing transaction histories and calculating capital gains. Now I use crypto tax software and consider tax implications before making trades.

- Falling for Scams and “Too Good to Be True” Opportunities: I almost fell for a phishing attempt promising “free tokens” from a fake version of a legitimate project’s website. The crypto space is, unfortunately filled with scams targeting newcomers. My rule now: if it promises guaranteed returns or free money, walk away.

The most dangerous mistake—and the one I still struggle with—is FOMO (Fear Of Missing Out). The crypto market is designed to trigger FOMO with its dramatic price movements and success stories of overnight millionaires.

My strategy for combating FOMO:

- Remind myself that there will always be another opportunity. Missing one pump doesn’t mean I’ve missed my only chance at profits.

- Calculate realistic return scenarios rather than focusing on best-case outcomes. If a coin has already risen 500%, what’s the realistic upside from here versus the downside risk?

- Stick to my predetermined entry criteria rather than making exceptions when something is pumping.

- Wait 24 hours before acting on FOMO feelings. Often the urge passes, or the price corrects, creating a better entry point.

Developing and Sticking to a Trading Plan

For my first year in crypto, my “strategy” was essentially: buy what’s popular, sell when I get nervous or greedy. Unsurprisingly, this produced erratic results. Creating a concrete trading plan transformed my approach from gambling to something closer to actual investing.

A good trading plan isn’t just about when to buy and sell—it’s a comprehensive framework for making decisions. Here’s what mine includes:

- Investment Goals and Time Horizon: I’ve defined specific financial targets and when I need to reach them. Some of my crypto is earmarked for long-term holding (10+ years), while other portions have medium-term goals (2-5 years).

- Entry and Exit Criteria: I’ve defined specific conditions for opening and closing positions:

- Technical criteria (support/resistance levels, RSI readings)

- Fundamental milestones (product launches, adoption metrics)

- Portfolio allocation limits (maximum percentage for any single asset)

- Profit-taking levels (25% at 2x investment, 25% at 3x, etc.)

- Risk Management Rules: My plan includes position sizing guidelines and maximum drawdown thresholds. I never put more than 5% of my crypto portfolio into a single small-cap project, and I have predetermined points where I reevaluate positions that are significantly underwater.

- Regular Review Schedule: Every quarter, I assess performance, rebalance if needed, and update my plan based on changing market conditions or new information. This prevents my strategy from becoming stale while still providing structure.

The most important aspect of any trading plan is actually following it. To hold myself accountable:

- I’ve shared my plan with trusted friends who check in on whether I’m sticking to it.

- I keep it physically printed near my computer as a constant reminder.

- I use timeouts before breaking any of my rules—if I’m tempted to deviate from the plan, I must wait 48 hours and write down my reasoning before doing so.

- I review instances where I broke my rules and analyze the outcomes to reinforce the plan’s value.

Advanced Tools and Resources for Cryptocurrency Traders

The right tools and resources can transform your crypto journey from confusing and stressful to organized and strategic. After years of trial and error, I’ve compiled a list of the most useful resources that have elevated my trading from amateur hour to something resembling competence.

Crypto Portfolio Tracking and Analysis Tools

When my portfolio grew beyond a handful of coins spread across multiple exchanges and wallets, manual tracking became impossible. Portfolio trackers solved this problem by aggregating everything in one place. Here are the ones that have worked best for me:

Awaken.tax became my go-to after trying several alternatives. What I love about it is the ability to connect to exchanges via API for automatic updates while also manually adding wallet addresses for my cold storage. The tax reporting features (which I’ll discuss later) sealed the deal for me.

CoinStats wins for its simplicity and clean interface. When helping my less tech-savvy friends get started with crypto, this is the tracker I usually recommend. The free version covers most basic needs, though I eventually upgraded for the advanced analytics.

For market analysis:

TradingView transformed my technical analysis capabilities. Its comprehensive charting tools and the ability to save custom layouts for different types of analysis helped me develop and test trading strategies.

Glassnode introduced me to on-chain analysis, which examines blockchain data for insights you can’t get from price charts alone. Metrics like NVT ratio (Network Value to Transactions), active addresses, and exchange flows have helped me identify potential trend reversals before they appeared on charts.

Educational Resources and Communities

The crypto space evolves so rapidly that continuous education isn’t optional—it’s essential for survival. The resources that have most improved my understanding include:

Formal Courses: Platforms like Coursera and edX offer structured learning about blockchain technology and cryptocurrency markets. The MIT OpenCourseWare series on blockchain was particularly eye-opening for me.

YouTube Channels: Benjamin Cowen, Coin Bureau, and Finematics provide high-quality educational content without the hype and sensationalism common in crypto media.

Books: “The Bitcoin Standard” by Saifedean Ammous and “Mastering Bitcoin” by Andreas Antonopoulos provided fundamental knowledge that has stood the test of time despite market volatility. For trading psychology, “Trading in the Zone” by Mark Douglas transformed my approach to managing emotions and expectations.

Podcasts: During my daily commute, podcasts like “Unchained,” “What Bitcoin Did,” and “The Defiant” keep me updated on industry developments. They’re especially useful for hearing directly from project founders and developers about their work.

The breakthrough in my crypto journey came when I stopped trying to figure everything out alone and tapped into community knowledge. The right communities can provide support, alternative perspectives, and early information about emerging trends—but choosing carefully is crucial.

Reddit communities vary widely in quality. r/CryptoCurrency offers general discussion but can be overwhelmed by memes and moon-farming during bull markets. More specific subreddits like r/BitcoinMarkets and r/ethfinance tend to have higher-quality analysis and discussion. I found my home in r/CryptoTechnology, which focuses on technical aspects rather than price speculation.

Discord servers for specific projects have given me direct access to development teams and fellow users. When I was deeply involved in a DeFi protocol, joining their Discord alerted me to an upcoming governance vote that would affect token value.

Twitter has been surprisingly valuable once I curated my feed carefully. Following developers, protocol founders, and thoughtful analysts (rather than price predictors) has given me insights into the direction of the industry and specific projects. The challenge is filtering signal from noise—I regularly audit who I follow to maintain a high-quality information stream.

Navigating Market Volatility

The first time I experienced a true crypto market crash was in January 2018. I’d been riding the euphoria of the 2017 bull run, watching my portfolio grow daily and feeling like a genius. Then, almost overnight, everything collapsed. I remember staring at my screen in disbelief as my portfolio dropped 30%, then 50%, then eventually over 80% from its peak. I wasn’t prepared mentally or strategically, and I made every mistake in the book—panic selling, trying to catch falling knives, and eventually just checking out completely in despair.

That brutal experience taught me something crucial: in crypto, volatility isn’t just a feature—it’s the defining characteristic. Learning to navigate these violent market swings has been the single most important skill in my crypto journey.

Understanding Crypto Market Cycles

After experiencing several complete market cycles, I’ve noticed patterns that, while not perfect predictors, help me maintain perspective during extreme conditions.

Crypto markets tend to move in multi-year cycles, historically correlated with Bitcoin’s halving events (when the new supply of Bitcoin is cut in half approximately every four years). These cycles typically include:

- Accumulation Phase: Following a major crash, prices stabilize at low levels. This is when smart money quietly accumulates positions. During the 2018-2019 crypto winter, Bitcoin hovered around $3,000-$4,000 for months. Most people had written crypto off as dead, but those who understood the cycle were buying. I regrettably missed much of this opportunity, still nursing my wounds from the crash.

- Early Bull Phase: Prices begin rising steadily, but with limited mainstream attention. Technical improvements and infrastructure development occur. This is when I’ve found the risk/reward ratio most favorable. In 2020, watching Bitcoin climb steadily from $5,000 to $10,000, I finally started rebuilding positions, though still cautiously.

- Mania/Bubble Phase: Exponential price increases, mainstream media coverage, and new investor influx. Everyone becomes a genius. During the 2021 bull run, I noticed eerily similar patterns to 2017—friends who had never mentioned Bitcoin were suddenly giving me investment advice, taxi drivers were discussing altcoins, and social media was flooded with price predictions. This time, I recognized the signals and started taking profits instead of getting greedy.

- Blow-off Top and Crash: A rapid price peak followed by a severe correction, often 80-90% for the overall market and even more for smaller projects. The crash from November 2021 to June 2022 followed this pattern perfectly. Having experienced 2018, I was mentally prepared this time, with preset sell targets and a bear market strategy ready to deploy.

- Bear Market/Crypto Winter: Extended period of declining or stagnant prices, project failures, and diminished public interest. This is where weak projects die and stronger ones build. During the 2022-2023 bear market, I forced myself to stay engaged, researching projects that continued development despite price declines.

Understanding these macro cycles has helped me avoid the worst market timing mistakes. When everyone is euphoric, I get cautious. When doom prevails, I start looking for opportunities.

Strategies for Different Market Conditions

My early mistake was using the same approach regardless of market conditions. I’ve since developed distinct strategies for different market phases:

Bull Market Strategies

- Systematic Profit-Taking: I now set predetermined sell targets (25% at 2x investment, 25% at 3x, etc.) and actually stick to them. During the 2021 bull run, this discipline allowed me to realize profits rather than watching paper gains evaporate.

- Reducing Leverage and Risk: As markets heat up, I paradoxically become more conservative, reducing leverage and trimming positions in more speculative assets. In late 2021, I eliminated all leveraged positions despite the temptation to maximize gains.

- Maintaining Cash Reserves: I set aside a portion of profits specifically for buying during the inevitable correction. Having this “dry powder” ready helped me capitalize on the mid-cycle dip in May 2021.

- Focus on Profit Protection: I tighten stop-losses and become more willing to exit positions that show weakness. The goal shifts from “maximum gains” to “preserving what I’ve made.”

- Mental Preparation for the Turn: I repeatedly remind myself that all bull markets end, usually faster and more violently than expected. I keep a journal with notes from previous crashes to maintain perspective.

Bear Market Strategies

- Dollar-Cost Averaging: Rather than trying to catch the exact bottom, I allocate fixed amounts at regular intervals to high-conviction assets. During 2022, I set up automatic weekly purchases of Bitcoin and Ethereum regardless of price action.

- Focus on Value and Fundamentals: I use downturns to accumulate projects with strong fundamentals, development activity, and real-world adoption. During the 2018-2019 bear market, I missed opportunities in projects that continued building despite price declines; I didn’t make that mistake again in 2022.

- Reduced Trading Frequency: I decrease overall activity, making fewer but more carefully considered moves. My trading volume dropped by about 80% during the 2022 bear market compared to the bull run.

- Capital Preservation: I increase cash positions and reduce exposure to smaller, riskier projects. In early 2022, I consolidated positions from over 15 different cryptocurrencies to just 5 core holdings.

- Mental Health Maintenance: I check prices and news less frequently, focusing instead on education and longer-term developments. Setting price alerts for specific levels allows me to step away from constant chart-watching.

The transition between these strategies isn’t always clear-cut—markets rarely announce “this is the top” or “this is the bottom.” I’ve learned to gradually shift approaches as I observe changing market conditions and sentiment.

Creating Contingency Plans

After being caught completely off-guard in 2018, I’ve developed detailed contingency plans for various market scenarios. Having these plans in place has reduced emotional decision-making during stress periods.

My Extreme Bull Market Plan

If the market enters what appears to be a parabolic phase (weekly gains of 20%+ across major assets):

- Accelerate profit-taking according to predetermined levels

- Move at least 30% of portfolio to stablecoins

- Remove all leverage and margin positions

- Set strict stop-losses on remaining positions

- Prepare shopping list for the eventual correction

My Market Crash Plan

If the market drops more than 30% in a week or shows signs of capitulation:

- Avoid checking portfolio value constantly (limit to once daily)

- Deploy no more than 30% of reserved cash, keeping the rest for potentially lower levels

- Focus purchases on the strongest fundamental assets rather than catching falling knives

- Extend time horizon expectations from months to years

- Review all holdings for projects unlikely to survive extended downturns

When the May 2021 crash occurred, having this plan ready prevented panic selling and allowed me to make rational decisions despite the chaos.

My Exchange Risk Plan

After the FTX collapse reminded everyone of counterparty risk:

- Keep no more than 20% of holdings on any single exchange

- Withdraw to self-custody any assets not actively being traded

- Maintain accounts on multiple exchanges with completed verification

- Keep detailed records of all holdings and transactions off-platform

- Set up alerts for unusual withdrawal activity

The simple act of creating these contingency plans has been almost as valuable as the plans themselves. The process forces me to think clearly about different scenarios during calm periods rather than making decisions under duress.

My Personal Crisis Plan

Sometimes life emergencies require accessing crypto investments at inopportune times:

- Maintain a separate “emergency liquidation” list prioritizing which assets to sell first (generally the most liquid with lowest long-term conviction)

- Keep at least 10% of crypto portfolio in stablecoins for immediate needs

- Establish lines of credit that could be used instead of selling during market bottoms

- Have documented access instructions for a trusted person in case of personal emergency

Having this plan has given me peace of mind that I could handle personal financial emergencies without catastrophically impacting my long-term crypto strategy.

The simple act of creating these contingency plans has been almost as valuable as the plans themselves. The process forces me to think clearly about different scenarios during calm periods rather than making decisions under duress.

Tax Considerations for Crypto Traders

My biggest face-palm moment came during my first tax season after trading crypto. I had made dozens of trades, had no record-keeping system, and suddenly realized I needed to report every single transaction. It was a nightmare that took me weeks to sort out.

Different countries have different rules, but in many jurisdictions:

- Crypto-to-crypto trades are taxable events (I had no idea about this at first)

- Mining rewards and staking income are often taxable

- Purchases made with cryptocurrency might trigger capital gains taxes

- Moving crypto between your own wallets is not taxable, but you should still track it

I now use cryptocurrency tax software (CoinTracker in my case) that integrates with exchanges and creates tax reports automatically. It costs me about $100 per year, but saves hours of work and potentially expensive mistakes.

Before you make your first trade, take an hour to research the specific tax rules in your country. In the U.S., for example, the IRS has been cracking down on crypto reporting, and the penalties for non-compliance can be steep. I’ve set aside a dedicated savings account with 25% of my profits specifically for tax obligations—something I wish I’d done from day one.

Specialized tax tools have since saved my sanity and potentially kept me from making costly reporting errors: